Ralph Paligaru – quick profile

revised in part on 15 and 16 December 2020 by Mark Smith

20 min read

Mark Smith : Updated on May 9, 2025

revised in part on 15 and 16 December 2020 by Mark Smith

I met Ralph in late March 2017. Below are the personal opinions (unless stated otherwise) of Mark Smith.

Ralph purports to have connections to people in high public offices in Fiji – Cabinet Ministers having, he claims, attended Marist College as a Schoolboy in Fiji where he has said that he formed childhood and longterm relationships with persons later coming to occupy, as I mentioned, high public offices in Fiji. It is believed that some of these connections include to persons within the Reserve Bank of Fiji, Fiji Hardwood Corporation and a number of Government Departments. It is believed therefore that some of the below profile may be of public interest to those trading with persons and dealing with government officials, in some instances, in Fiji as well as interest to foreign persons providing aid, trade or other support to Fiji. This profile may also be of interest to Australians – Australia contributes a substantial sum of aid to Fiji and naturally as a sovereign nation we have an interest in the good governance of the Country of Fiji – one of our closest neighbours together with an interest in efficient and proper utilisation of Australia’s Aid provided to Fiji. Regrettably, Fiji, it is reported, has a problem with corruption along with other countries within the region. We do not suggest Ralph is involved in public wrongdoing, just the developing nature of administration and governance in some parts of the still developing world. The below article may also be in the public interest of persons from or interested in India. The public interest of Australia may also be involved – Ralph and his former employer (discussed below, man named Mohan Kumar) lobbied and received Visa’s and other benefits, as a result of lobbying and other likely legitimate dealings, from officials and public office holders in Australia.

Ralph Ignatius Paligaru (“Paligaru“) is the director of Dural Alliances Pty Ltd (in liquidation) and Mills Management (Fiji) Pte Ltd which has a lease or operating agreement over the Dreketi Timber Mill from the defunct Taiwan Timber Co, Fiji.

It is unclear whether any secured or unsecured creditors of Taiwan Timber Co, Fiji benefit from the lease arrangement – but we say that analysis of the tenant is in the interests of creditors, stakeholders including suppliers to Dreketi Timber Mill and generally in the public interest particularly in Fiji.

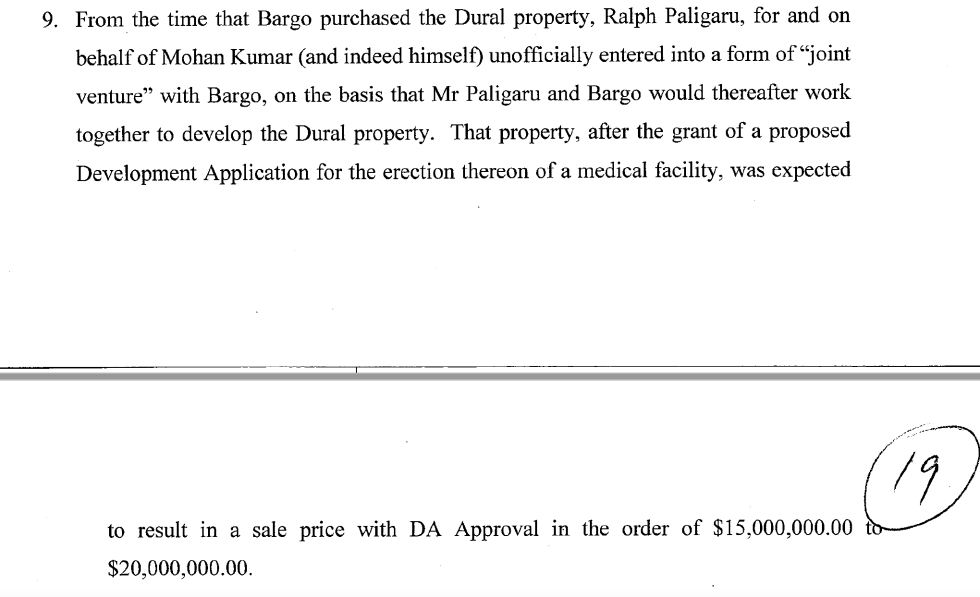

Ralph has charged his shares in these 2 companies to my company DCP Litigation Holdings Pty Ltd (secured by 2 duly perfected PPSR’s).

Below is a chronology of key dates and events which the writer, Mark Smith believes to be true:

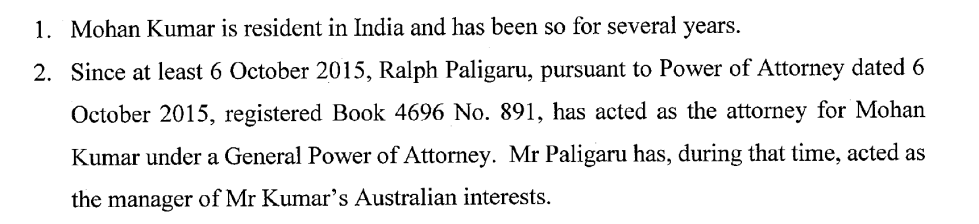

Some time before 2015, probably well before 2015, Ralph was employed by a man known as Mohan Kumar. A detailed profile on this person is discussed by following the links to pages tagged Mohan Kumar aka Chhota Rajan.

On or about 6 October 2015, Mohan Kumar granted to Ralph a power of attorney with powers as to the management of Kumar’s affairs and property interests. A true copy of the Power of attorney is accessible here: click link.

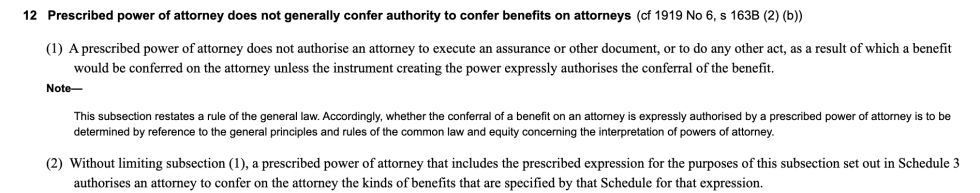

The power of attorney granted does not expressly authorise Ralph Paligaru to confer personal benefit/s upon himself. In addition to the POA duties and obligations, Ralph continued to be on the payroll of Mohan Kumar (as his Manager until late May 2016) and thus owed obligations in contract to Mohan Kumar, Ralph’s then employer. The relevant Act provides:

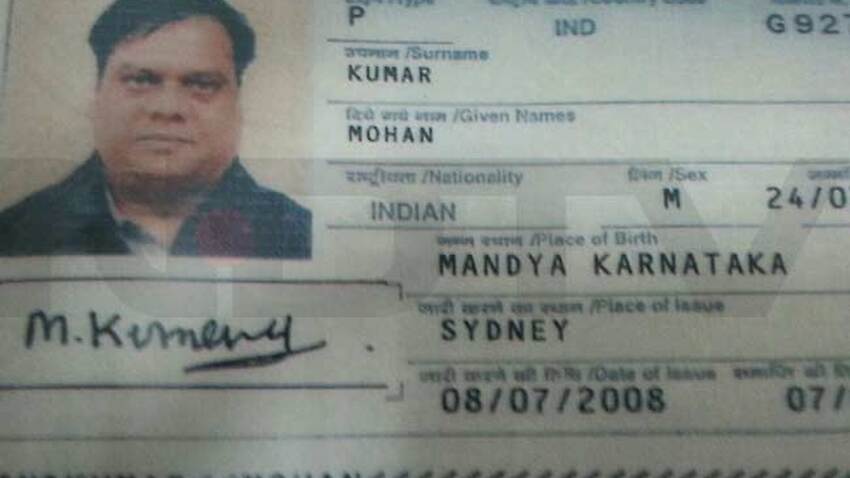

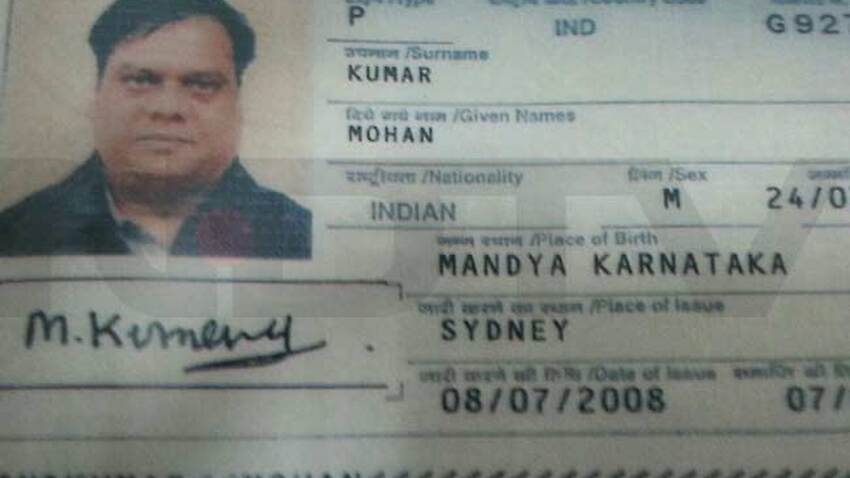

On or about 25 October 2015, Mohan Kumar (apparently bearing a fake passport in the name of Mohan Kumar) boarded a plane at Sydney and travelled to Denpasar, Bali, Indonesia. It is believed that Ralph Paligaru, on the same day, travelled from Sydney to Denpasar – but on a separate flight – Ralph has provided oral admissions to me to that effect that he did not travel with Mohan Kumar but he did travel to Bali on the same day as did Mohan Kumar – Ralph’s then employer.

Upon arrival in Denpasar, the person claiming to be Mohan Kumar was arrested according to reports. The true identity of the traveller is not known to me however photographs of the person and his fake passport have been reported widely in global news sites including in India. The fake passport carried by the traveller known as Mohan Kumar was issued, it is reported, in Zimbabwe by India and later re-issued in Sydney – a matter of public interest to residents of Australia. A reported copy of the fake passport of Mohan Kumar is shown below:

I understand that corruption related cases have been been conducted re the issue of the fake passport in India alleging that the person carrying that fake passport is in fact Rajendra Sadashiv Nikalje – also known as Mumbai gangster Chhota Rajan. To the best of my knowledge the traveller has not admitted to being Chhota Rajan. Links to an article by SBS containing these allegations is here: https://www.sbs.com.au/news/indian-mobster-hid-in-australia-for-7yrs

It is believed that Ralph was employed at all material times by Mohan Kumar at or concerning 632 Old Northern Rd, Dural. It is believed Ralph’s title of employment was, officially Manager of Kumar’s Australian interests.

To the best of my knowledge, Ralph stayed in Bali for approximately 1 night before returning to Sydney, accordingly I do not believe that Ralph’s visit to Bali was for or turned out to be for a vacation?

Mohan Kumar was arrested in Bali on about 25 October 2015, upon his arrival there and subsequently extradited to India.

The writer has located the following video believed to be an accurate report from a well known global news sources (AP):

SBS reports that Rajendra Sadashiv Nikalje is wanted in India over the deaths of at least 20 women: see article – https://www.sbs.com.au/news/indian-mobster-hid-in-australia-for-7yrs

The writer has no knowledge of the truth of these allegations but says he was informed upon meeting Ralph Paligaru in March 2017 that Ralph was aware of such allegations. The writer is aware of Ralph’s concerns, in writing to Dennis English, a former lawyer of Ralph’s of being “lynched“.

The writer understands that Mohan Kumar appeared to be of good character during his residence in Australia over the period of about 12 years from about 2003 (on and off) till October 2015 approximately.

The writer has seen correspondence held by Ralph Paligaru written to the local member of Mohan Kumar being Phillip Ruddock (a highly reputable MP) which states that Mohan Kumar is in effect a reputable business person making investments which are, or seem to be, legitimate in Australia in the MP’s electorate and elsewhere. A copy of the letter can be seen by clicking this link: Letter to Phillip Ruddock MP. I was provided with a copy of this letter by Ralph.

During late 2015 or early 2016, Ralph Paligaru appointed Jon Brookes of Brookes Partners as agent to sell 632 Old Northern Rd, Dural.

On or about 5 July 2018, Ralph Paligaru informed me he believed that the appointment provided to him a personal benefit (discussed below).

Ralph assigned the debt to my company seeking that my company would recover for Ralph’s benefit a referral fee.

In the interests of Mohan Kumar, it is unclear why Ralph didn’t simply negotiate a lower fee than that which was agreed on the sale of 632 Old Northern Rd from the selling agent, Brookes Partners?

Between April and May 2016, as Kumar’s POA, Paligaru was involved in negotiations for the sale of 632 Old Northern Rd, Dural being folio 1/228521 (“the land”) with Adams, director of the purchasing vehicle company, Bargo. A number of transactions were considered including a call option or vendor finance.

Around late April 2016, Ralph retained Dennis English of DCE Lawyers (“DCE”) in his capacity as POA for Kumar. The writer does not suggest that DCE provided anything other than sound legal advice to Ralph. Ralph provided me all the below emails (waiving privilege).

Around late April 2016, Craig and Bargo retain Guy Vinden (“GV”) as solicitor.

In April 2016 Ralph negotiated to receive an interest in Craig’s Dural project via a Heads of Agreement (Joint Venture or JV) between Ralph, Craig and another person named Andrew Murray, entered into confidentially at around the time when Ralph was both an employee of the former vendor of the Dural Land, Mohan Kumar and acted as Mohan Kumar’s Power of Attorney.

In later correspondence received from John Mahony of Mahony Law (Ralph’s lawyer but also a person who acted for, and was paid at various times by, Mohan Kumar as well as Craig Adams / Bargo Developments – a company owing Mohan Kumar more than $4m), John Mahony wrote the following:

It is noted that whilst John Mahony was Ralph’s lawyer, Bargo’s lawyer and Mohan Kumar’s lawyer, John Mahony had not (at the time) provided a written fee disclosure to Mohan Kumar – see attached letter from John Mahony – click here to view.

The writer is aware that Mahony claims to have orally disclosed costs (but not in writing) at some relevant times.

During a period when John Mahony had no written fee disclosure to Mohan Kumar (and he was acting for Ralph Paligaru (who had sought various personal benefits) and for Bargo Developments (who owed Mohan Kumar $4m+), John Mahony issued tax invoices to Mohan Kumar for $99,310.54 – copy of email and bills available – click here.

It is unknown whether Mohan Kumar knew of the shareholding Ralph was to receive via the Heads of Agreement (Joint Venture) or approved, although the writer notes the Heads of Agreement purports to be confidential and Ralph wrote concerning what he said was a “vested interest”. One such email can be viewed here by clicking this link.

It is unknown why, if the JV was for the benefit of Mohan Kumar, the shareholding and other benefits provided for in the JV were not simply made in the name of Mohan Kumar (the POA did not expressly permit Ralph to confer benefits upon himself)?

On or about 2 May 2016, Kumar’s solicitor, DCE advised Paligaru strongly against vendor finance for any transaction with Bargo. Paligaru as POA for Kumar did not follow the advice. Copy of correspondence coming soon.

Between 9 and 10 May 2016, DCE and GV exchange correspondence. Copy of correspondence coming soon.

On 20 May 2016 at 1.51pm, DCE continued to advise Ralph, as Kumar’s solicitor, against vendor finance. Copy of correspondence coming soon.

Between 2.51pm and 3.04pm on 20 May 2016, DCE ceased to act for Kumar (at Ralph’s discretion). Copy of correspondence – click here.

On or about 20 May 2016, Paligaru appointed himself to act on the conveyance for Kumar to the ownership of Bargo. Copy of correspondence – click here for front page of contract.

On 21 May 2016, Paligaru writes to DCE seeking legal advice in order to avoid being “lynched”. Copy of correspondence – click here.

On 23 May 2016 at 9.08am, Murray replies to Paligaru. Copy of correspondence – click here.

On 25 May 2016 at 4.25pm, Paligaru receives a signed copy of the Bargo JV. Copy of correspondence coming soon.

At or about 23 to 25 May 2016, Paligaru received employment (or a contract of some kind) to commence upon settlement, on terms of approx. $5,000 per month directly from Brookes Partners, managing agents for Bargo (Bargo, replacing Mohan Kumar as outgoing vendor and lessor). Copy of correspondence coming soon. Ralph received a monthly payment from Brookes Partners from the rent that Bargo was entitled to from the tenant of 632 Old Northern Rd, Dural after completion.

Until 31 May 2016, Kumar was the vendor of 632 Old Northern Rd, Dural being folio 1/228521 (“the land”), subsequently Bargo became its registered proprietor.

On or about 31 May 2016, through Paligaru under the POA, Kumar entered a contract for sale of the land in the sum of $5.5m. Kumar received the sum of $1,500,000 at settlement and taking a vendor’s lien for the sum of $4,000,000 secured by an unregistered mortgage (but didn’t register a caveat initially), an executed blank share transfer for 100% of the shares in Bargo Developments Pty Ltd (“the purchaser”) as detailed in the contract (“Kumar’s interest”). The vendor’s lien was between the vendor and purchaser however the sum was guaranteed by the director of the purchaser (“guarantor”). Copy of extracts of these documents – click here to view.

On 6 June 2016, Ralph Paligaru ABN 27860074875 issued tax invoice 1002 in the sum of $60,500 to Jon Brookes of Brookes Partners Real Estate for a personal referral fee – for referring the listing of Mohan Kumar’s land (Ralph was POA to Mohan Kumar) at 632 Old Northern Rd, to be listed and sold to Craig at Bargo for $5.5m (of which only $1.5m was paid and the balance of $4m remained unpaid pursuant to the vendor’s lien). It is unclear whether Ralph intended to disclose this “commission” to Mohan Kumar, the original owner of the Dural land nor why Ralph didn’t simply seek a $60k reduction in commission for his employer? A copy of the invoice from Ralph to Brookes Partners Real Estate – click here to view.

Between May 2016 and March 2017, the terms of the $4,000,000 vendor’s lien were defaulted upon.

On or about 15 March 2017, Lisa Natoli (the Chief Financial Officer of the mortgage manager for Pacific8 including Kesinda and its predecessor, N&M, see below, corresponded with Andrew Kingston (“Kingston”), Managing Director of Winchester O’Rourke, a closely related party of the mortgage manager for Pacific8.

On 15 March 2017, Kingston wrote to Justin Hatfield (“Hatfield”), mortgage broker for the purchaser. Copy of correspondence coming soon.

During the day and the evening of 22 March 2017, Paligaru made a series of calls to me seeking increasingly urgent someone to discuss the Bargo defaults and directions (that evening, except he had to attend his son’s school function), in securing unpaid monies pursuant to the unpaid vendor lien.

On 23 March 2017 at or about 7.30am, I met with Paligaru at his residence at 88 Perfection Ave, Stanhope Gardens.

Paligaru informed me the POA he held for Mr. Kumar who resided in an Indian prison (and would do so, Ralph said, on a life sentence).

During the meeting I enquired of Paligaru a series of questions concerning the vendor’s lien, and his exercise of the POA as follows (words to the effect) …

Me: “Okay, you’ve entered into the sale of this land for $5.5m under this contract, how much money did you, Kumar, actually receive?”

Paligaru: “About $1.5m on settlement”.

Me: “Who signed the contract, you under the POA or Kumar?”.

Paligaru: “Me, under the POA”.

Me: “So where is the title deed?”.

Paligaru: “Um, we, I gave it to Craig Adams”.

Me: “So you held the title, but gave it to Adams?”.

Paligaru: “Yes”.

Me: “So you are saying you just gave Craig Adams the title deeds to a piece of land worth $5.5m and he went off and did whatever he liked with the property?”

Paligaru: “It wasn’t like that, he promised in the contract to pay it back with interest.”

Me: “But so far, has he kept his promises.”

Paligaru: “No, not exactly.”

Me: “Whose idea was the vendor finance?”.

Paligaru: “Craig Adams and I came up with it, more or less, together”.

Me: “But ultimately, who approved it, you or Kumar?”.

Paligaru: “Me, I have full authority under the POA to manage his affairs however I see fit”.

At 7.47am on Friday 23 March 2017, I searched the register of the land for records of any persons claiming an interest in the land. I discovered registered interests in the land by Bargo, N & M Investments/Properties Pty Limited (“N&M”) and POE. Copy of search document coming soon.

On or about Friday 23 March 2017, (at my instigation) a caveat was recorded upon the title to the land to protect his interest. The caveat was sworn by Paligaru under the POA for Kumar (the Smith Caveat). A copy of the caveat as registered can be viewed here – click link – coming soon.

At 9.36am on Monday 27 March 2017, once aware of the interest of N&M, I searched N&M’s particulars, to know where to correspondence with N&M. Copy of correspondence coming soon.

On Monday 27 March 2017 (at 12.23pm), at my instigation, I conducted a grantor search on Bargo / Adams to see whom he’d given PPSR’s to. Copy of correspondence coming soon.

At 1.24pm on Monday 27 March 2017, I contacted the second mortgagee, POE, to discuss breaches of the vendor lien terms. Copy of correspondence coming soon.

On or about Monday 27 March 2017 (the next business day), at my instigation, I wrote and delivered a “no-tacking letters” to the first mortgagee at that time only owed circa $2.675m and the second mortgagee whom I knew professionally. Copy of correspondence coming soon.

On or about 2pm on Tuesday 28 March 2017, I served the no-tacking letter upon N&M’s registered office via its company secretary, Anthony John Catalano. Copy of correspondence coming soon.

On Wednesday 29 March 2017 at 11.41pm, I wrote by email to Mr. Catalano (copied to Paligaru) the first mortgagee (and solicitors for the second mortgagee) about the default of Bargo pursuant to the $4m vendor’s lien. Copy of correspondence coming soon.

Between 11.41pm on Wednesday 29 March 2017 and 6.05am on 30 March 2017, unbeknownst to the writer, Catalano wrote to Kingston supplying my email to Catalano. Copy of correspondence coming soon.

Between 28 and 30 March 2017, N&M the prior mortgagee to Kesinda and its manager received actual notice of the prior interest of Kumar. We can provide upon request a true copy of the relevant title searches, emails and notices given to the prior mortgagee to Kesinda (“N&M”) and Kesinda’s manager, Pacific 8 and/or Winchester O’Rourke, in particular its Managing Director Andrew Kingston (“the mortgagee’s manager”). Through Paligaru and Mahony, Kumar conducted mediation with Pacific 8, Kesinda, Kingston and the writer. Copy of correspondence coming soon.

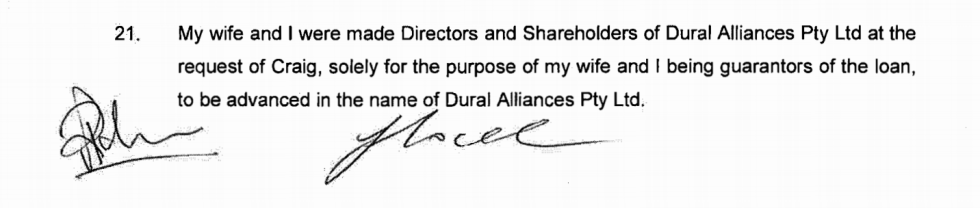

In late July 2017 Dural Alliances Pty Ltd as a company was set-up with and by Ralph and his former partner Craig (see below) in the land and development proposed project at 632 Old Northern Rd, Dural (“the Dural land“).

In furtherance of unknown purposes, Ralph in August 2017 borrowed $540,000 from Franklin Yeezy Holdings Pty Ltd, which he supplied for the benefit of Craig Adams – to refinance loans secured to multiple of Craig’s properties. Ralph was and still is (to our knowledge) the registered power of attorney of the former vendor, Mohan Kumar.

Some clues as to the purpose that Ralph borrowed the Franklin Yeezy funds might be found in this email – click here or alternatively in reading Ralph’s affidavit in those proceedings?

A mortgage (variations of which Mahony negotiated) and a deed (the deed preparation is thought to have involved John Mahony of Mahony Law) purport to have been entered in August 2017, a couple of days before the Franklin Yeezy advance. The Deed appears to have been witnessed by John Mahony of Mahony Law. The mortgage of Franklin Yeezy was prepared, to the best of my knowledge by David Lalic of Strategic Legal.

Under the deed, the Paligaru’s were also to receive the sum of $20,000 – clause 1.

The Deed entitled Dural, Ralph and Amreeta to things including a charge with the right to caveat that interest in Warriewood properties owned by another of Craig’s companies – Golden Arrow International Pty Ltd (in liquidation) however this caveat was registered (we do not know why there was a delay) not on 4 August 2017 but, we understand about 6 December 2017.

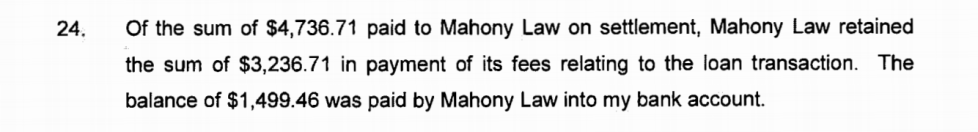

Ralph gave sworn evidence that Mahony Law was paid for their services as follows:

Confusingly, the writer is also aware, contradicting paragraph 24 of Ralph’s affidavit above, John Mahony of Mahony Law in fact issued invoice 67519 to Bargo Developments (e.g. Craig Adam’s company and not to Ralph Paligaru or Dural Alliances?) for preparation of the Deed and other items?

A copy of the accompanying email from John Mahony to Ralph – click here.

The writer is unaware whether John Mahony of Mahony Law had any conflicts between his clients – Bargo Developments whom he issued invoice 67519 to – and Ralph & Amreeta Paligaru who mortgaged their family home – 88 Perfection Ave, Stanhope Gardens (default rate of 6%/month, e.g. >72% pa)?

The writer notes Mahony’s invoice to Bargo whereby Mahony’s email refers to the following which is confusing:

It is unclear why the invoice wasn’t issued to Ralph if Mahony was acting on behalf of Ralph (and not Bargo)?

A search of records show that caveat AM936966 was registered for the Paligaru’s – Ralph & Amreeta on the Golden Arrow Land in Warriewood pursuant to the 4 August 2017 Deed – caveat can be inspected by clicking here.

The writer is unsure of the reason for the delay of four (4) months between the entry of the Deed witnessed by John Mahony of Mahony Law and registration of the caveat (apparently lodged by John Mahony of Mahony Law?

The writer observes that the Deed is dated 4 August 2017 but the caveat is only attested (it seems) by Ralph (and not Amreeta) on 27 November 2017?

As a general rule it is understood that the law is that:

“where equities are equal, the first in time prevails”.

The writer notes that four (4) months, from August 2017 to 6 December 2017 (if correct) was a sufficiently long time by which time the Paligaru’s interest in that land at Warriewood was, it seems, postponed.

Postponement means, in simple terms, instead of a person receiving secured money before X person, that person is postponed behind X person (another person receives payment first or in priority).

It is believed that the decision not to (for reasons unknown) lodge caveats in August 2017 (until 6 December 2017) and the subsequent postponement that follows meant that Australasian Property Group Pte Ltd – controlled by Ian Jordan and Maya was paid (I believe circa $540,000) in priority to the charge of the Paligarus.

It is unknown who was responsible for the lodgment or non-lodgment of caveats or the circumstances for delay but observe the caveat appears to have been ultimately lodged with the reference “Mahony 398989” and the caveat states that it was attested before John Mahony (on 27 November 2017).

As mentioned elsewhere, Australasian Property Group Pte Ltd – operated by Ian Jordan – provided Craig a personal loan later secured to the Warriewood land (in priority to the Paligaru’s) – a copy of the relevant personal loan documents can be viewed here and here.

The APG person loan document appears to be witnessed by Ian Jordan who purports to be a director of APG? It is believed that, as Ralph has connections with Fiji, so to does Australasian Property Group Pte Ltd? The writer understands that Ralph and Ian Jordan travelled together in or to Fiji on business and considered a number of potential transactions? It is believed that some money (legitimately) changed hands between Ralph and APG in regards to transactions?

Ultimately, Ralph & Amreeta – it is believed – did not receive repayment of the sum of $540,000 from Craig Adam’s company Golden Arrow International Pty Ltd, postponed behind Australasian Property Group Pte Ltd. Accordingly interest became payable, secured to their house at 88 Perfection Ave, Stanhope Gardens to Franklin Yeezy. The Franklin Yeezy loan became subject to an interest rate of 6% per month (in default) as a result of that non-payment. John Mahony of Mahony Law provided advice to the Paligaru’s on the mortgage (and facilitated variations) and deed and was paid for his services (see above) in the sum of $3,236.71.

By my reckoning, interest on $540,000 at 6% per months amounts to around $32,400 in the first month in default.

In month 2 the interest (calculated on principal plus default interest) compounds, if not paid, to around $34,000 PER MONTH.

It is difficult to fathom why a person (such as Ralph and Amreeta) might provide such generous, high risk support to another person they did not know well, e.g. Craig? That is – it is difficult to comprehend why the Paligaru’s would be prepared to borrow on high risk terms for this particular 3rd person?

The precise benefit (if any) available to the Paligaru’s for their guarantee and provision of security is not known?

The writer is aware of an extract of a sworn affidavit of Ralph which can be viewed here – click link where Ralph provides some explanation in his own words for the provision of this financial support. I understand this affidavit was read in open court in December 2019.

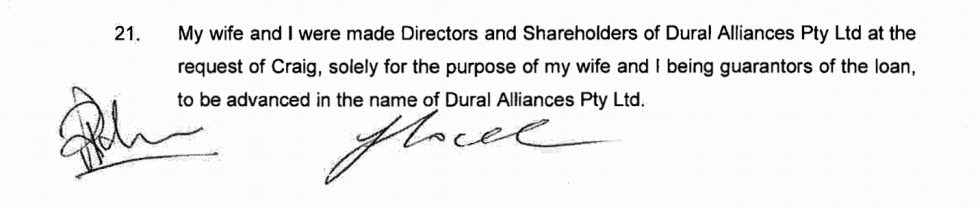

Elsewhere Ralph swore the following:

The writer is aware that Ralph and Craig, at around the time the Dural land was being sold to Craig‘s companies named Bargo Developments Pty Ltd (also in liquidation), did sign a document – referring to itself as a Heads of Agreement – which appears to grant to Ralph an interest in a future Special Purpose Vehicle (sometimes people refer to similar vehicles as joint ventures).

On its face, the Heads of Agreement concerns the Dural land whereby Ralph would end up with a significant interest in a private hospital at a future point? Or at least the document suggests this intention – you be the judge: click here.

The Heads of Agreement, now well known in certain circles contains the words “confidential information” however confidentiality was waived by Ralph in 2017. Particularly, Ralph intended to require (he told me, in effect) specific performance of this Heads of Agreement writing the following email to me – click here to view.

The writer is not saying what the meaning of this particular email is but according to Ralph, Ralph wrote that he believed he had what he said he believed in July 2017 (shortly before taking out the Franklin Yeezy borrowings) was a “vested interest” claiming “this is my deal“. The writer is not aware that Ralph ever himself resiled from having the interest the Heads of Agreement purports to grant him, or that he refers to as a “vested interest”.

A copy of the email written by Ralph containing these words is available for review by clicking here. You be the judge what the document means – if anything?

The writer is unaware of the legal effect of the Heads of Agreement document – viewable here.

It is noted on its face, the Heads of Agreement appears to involved Craig Adams (“Craig“), Ralph and another person named Andrew Murray? Nothing is known of Andrew Murray other than what is contained in the Heads of Agreement and Ralph’s email.

On or about early January 2018, Kesinda took its interest in the land (on notice, through N&M and the mortgagees manager of Kumar’s prior interest, assigned to DCP Litigation Holdings Pty Ltd).

Between February and March 2018, Kesinda procured from Reliance a postponement of its interest in the land.

On or about July 2018, Paligaru introduced the ultimate buyer of 632 Old Northern Rd, Dural under Pacific 8’s mortgage sale – the Galea Family. That purchaser (or their agent) signed further agreements with Paligaru (conferring upon Ralph various benefits). The Galea / Paligaru agreement (or attempted agreement) was facilitated in part by Kumar’s former lawyer John Mahony.

In July 2018, Kesinda, successor to N&M sold the land at Dural by public auction. Copy of documents coming soon.

To 25 August 2018, as assignee I calculated and believe that DCPLH is owed $5,339,928.99 from the above assignments from Kumar plus interest and costs. Bargo failed to dispute the amount or fact of the debt.

To 25 August 2018, as assignee I calculated and believe that DCPLH is owed $540,000 from the assignments from the Paligaru & Dural Alliance plus interest and costs since Bargo failed to dispute the amount or fact of the debt.

On 26 October 2018, I gave Paligaru and each of Kesinda and the parties in the Kesinda proceedings notice of the application for windup of Bargo pursuant to the assigned debts.

Each of Kumar, Paligaru, Dural Alliances and Amreeta stood by, not disputing the assignment (Kumar to DCP, Paligaru/Dural Alliances to DCP), whilst the Applicant as their assignee proved its debt and caused the winding up of Bargo pursuant to the Bargo debts.

In the early morning of 14 November 2018 I swore an affidavit of debt.

On 14 November 2018, the Supreme Court of Victoria order upon the Applicant’s windup application concerning Bargo.

In July 2019, Mahony appeared for Mohan Kumar in a mediation with Adam Tilley and Pacific8‘s related party Kesinda, as well as Australasian Property Group and others. Ralph attended the mediation as the personal legal representative of Mohan Kumar. The mediation resulted in Mohan Kumar being paid a substantial sum which I understand was applied to pay legal expenses and to, at least in part, pay to reduce the indebtedness of Ralph and Amreeta Paligaru to Franklin Yeezy.

Also (possibly a coincidence), around the time of the mediation (on 31 July 2019) Ralph through a company he incorporated in Fiji named Mills Management (Fiji) Pte Ltd entered into a triparte lease with HFC Bank and Taiwan Timber Company (Fiji) Limited (in administration)?

It is believed that at the time the Taiwan Timber Company (Fiji) Limited owed HFC Bank under a mortgage together with an unknown number of creditors several million Fiji Dollars. The HFC Bank mortgage, we understand, is stamped to FJD$7,696,535.00 – surely a great sum for the shareholders of the HFC Bank if they are still carrying a debt of amount (it is believed that Taiwan Timber Company (Fiji) Limited is insolvent and in administration)?

We understand the director of Taiwan Timber Company (Fiji) Limited is a personal named: Mr Shin Ho Yu. The writer understands that under the triparte lease, Ralph’s company pays HFC Bank around FJD$85,000 per month? The writer is unaware if the timber mill has operated during the Covid period in mid to late 2020, the current status of the lease or the status of Ralph and his company’s relations with HFC Bank?

In February 2020 Dural Alliances was wound up in the Federal Court of Australia by my company, DCP Litigation Holdings Pty Ltd – see the attached court order – click here.

Later DCP Litigation Holdings proved a debt owed to it by Dural Alliances in the amount of $179,999.82 – the same source of debt alleged in order to windup that company – court order obtained here.

Ralph Paligaru had notice of the winding up of Dural Alliances and did not attend court nor did he contest the debt. A copy of the creditors statutory demand served upon Dural Alliances and an affidavit of service is attached here – click link.

The debt owed which the court held to be owed by Dural Alliances to DCP Litigation Holdings arises, I say and the court held, under a Deed also entered into by Ralph personal together with his wife Amreeta.

Alternatively, Ralph as director of the company Dural Alliances did not dispute the debt alleged to be owed to DCP Litigation Holdings. Under the same deed, if binding, Ralph may also have a liability to my company personally (noting he as director did not dispute that Dural Alliances owed the same alleged sum that led to the Dural Alliances company being wound up).

Unfortunately, subsequent to signing the Deed, Ralph has cooperated less and less toward achieving the objectives and purposes of the Assignment Deeds (Kumar to DCPLH, Paligaru/Dural Alliances to DCPLH) such that on 8 January 2019, Mark Smith for DCP Litigation Holdings accepted the repudiation by Ralph of the Deed.

As at 26/11/2020, John Mahony continues to act for Ralph Paligaru.

John Mahony has previously acted for Mohan Kumar (who Ralph holds a POA over) and has previously worked with Craig Adams.

In or about February 2020, Adam Tilley’s Pacific8 (the holder of an AFSL) loaned money under a 1st mortgage to Ralph and his wife. Adam Tilley’s Pacific8 (the holder of an AFSL) also, purely by coincidence, loaned money to Craig’s company Bargo (who bought Dural from Kumar) in 2016, 2017 and 2018 under a series of differently named lenders before appointing agents and selling 632 Old Northern Rd, Dural under its mortgage/power of sale.

These loans may be a coincidence, the writer does not suggest any wrongdoing by Pacific8 (the holder of an AFSL)? A further coincidence is that Adam Tilley’s Pacific8 (the holder of an AFSL) and Franklin Yeezy shared the same lawyer – Summer Lawyers a firm who do specialise and act for a large number of Sydney based private lenders.

The writer is only opining that “its a small world” and does not suggest any wrongdoing.

The writer also notes that Mr. Tilley is not an owner of Franklin Yeezy Holdings Pty Ltd.

On or about 20 July 2020, DCP Litigation Holdings filed a cross-claim and consent judgment (signed by Ralph’s lawyer John Mahony) against Ralph Paligaru in the sum of $106,551.

On 11 September 2020, the Supreme Court of NSW issued orders under the consent judgment in favour of DCP Litigation Holdings against Ralph Paligaru – a copy of that consent judgment may be view here – click link. DCP Litigation Holdings is taking steps to enforce that judgment. Ralph has indicated directly and through his lawyers that he does not wish or intend to become bankrupt. To date, the judgment sum has not been satisfied (not paid) – partially or fully.

If the writer believes there is further detail adding to the profile of Ralph Paligaru which come to light in the public interest to people, tax payers, business community, bankers, governments or others in Australia, Fiji, India and elsewhere, he reserves the right to publish appropriate materials.

For more information – chat with us live using our instant chat tools (bottom corners), book an appointment or call now on 1300-327123 (till late).

To contact us with any tip-offs, files or information – please use the instant chat tools or form below:

revised in part on 15 and 16 December 2020 by Mark Smith

revised in part on 15 and 16 December 2020 by Mark Smith

Craig Adams and Ralph Paligaru together borrowed money against Ralph & Amreeta’s house at 88 Perfection Ave, Stanhope Gardens. The application states...

revised in part on 15 and 16 December 2020 by Mark Smith

revised in part on 15 and 16 December 2020 by Mark Smith

revised in part on 15 and 16 December 2020 by Mark Smith

revised in part on 15 and 16 December 2020 by Mark Smith

I received the following WhatsApp message (apparently from Ralph Paligaru … see WhatsApp message ID).

John Francis Thomas Mahony Date of NSW Admission 11/02/1977 Practising Certificate Type Principal of a law practice Principal Place of...